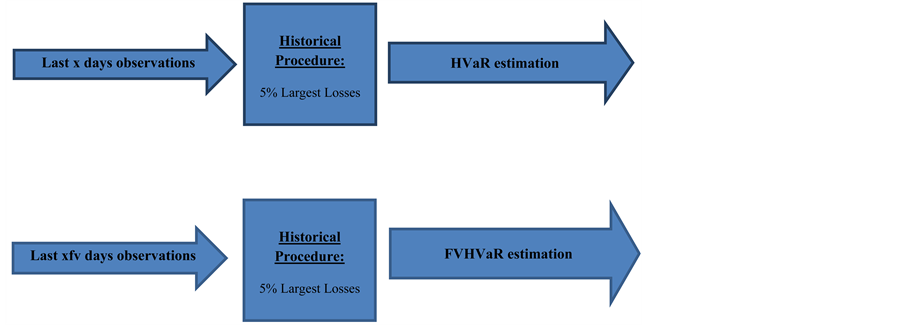

Value at Risk (VaR) Historical Approach: Could It Be More Historical and Representative of the Real Financial Risk Environment?

Elements of Financial Risk Management Second Edition © 2012 by Peter Christoffersen 1 Simulating the Term Structure of Risk Elements of Financial Risk. - ppt download

![PDF] Filtered Historical Simulation 1 Filtering Historical Simulation . Backtest Analysis | Semantic Scholar PDF] Filtered Historical Simulation 1 Filtering Historical Simulation . Backtest Analysis | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/2b532216befa96f948bafaf0a5b3a9f36d7fc46b/12-Figure1-1.png)

PDF] Filtered Historical Simulation 1 Filtering Historical Simulation . Backtest Analysis | Semantic Scholar

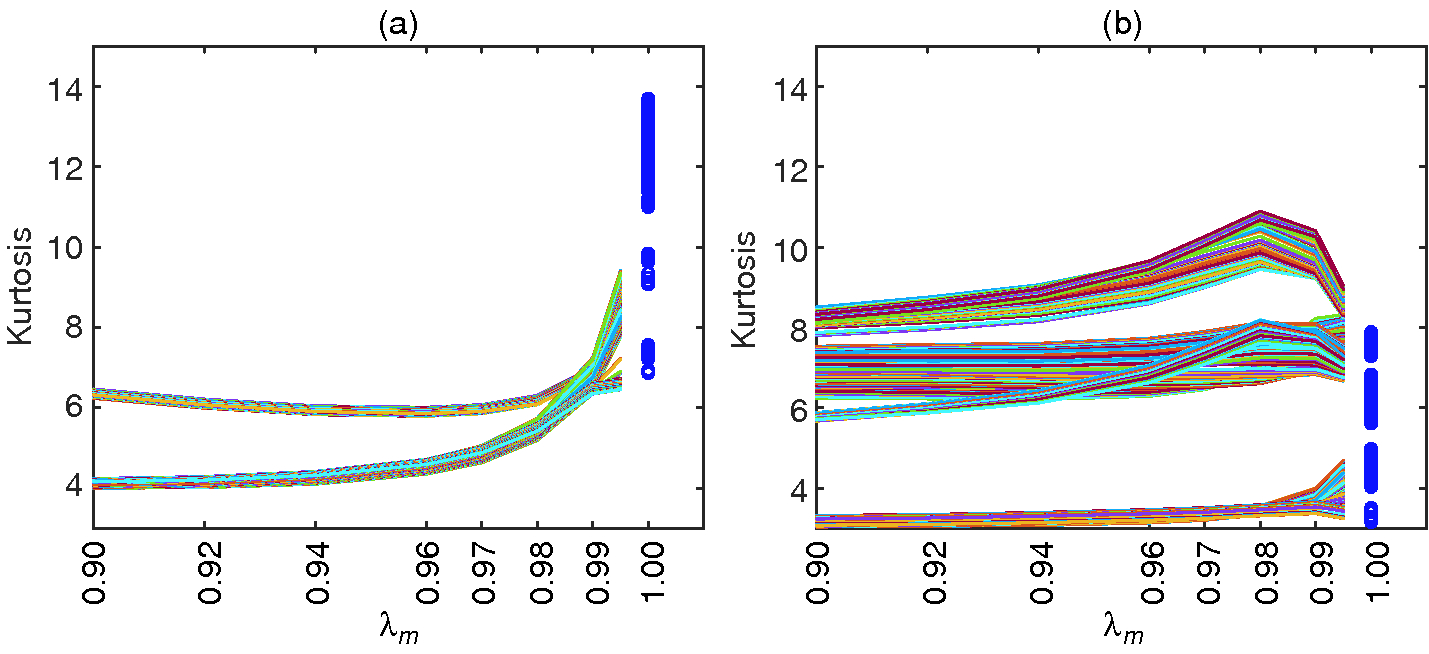

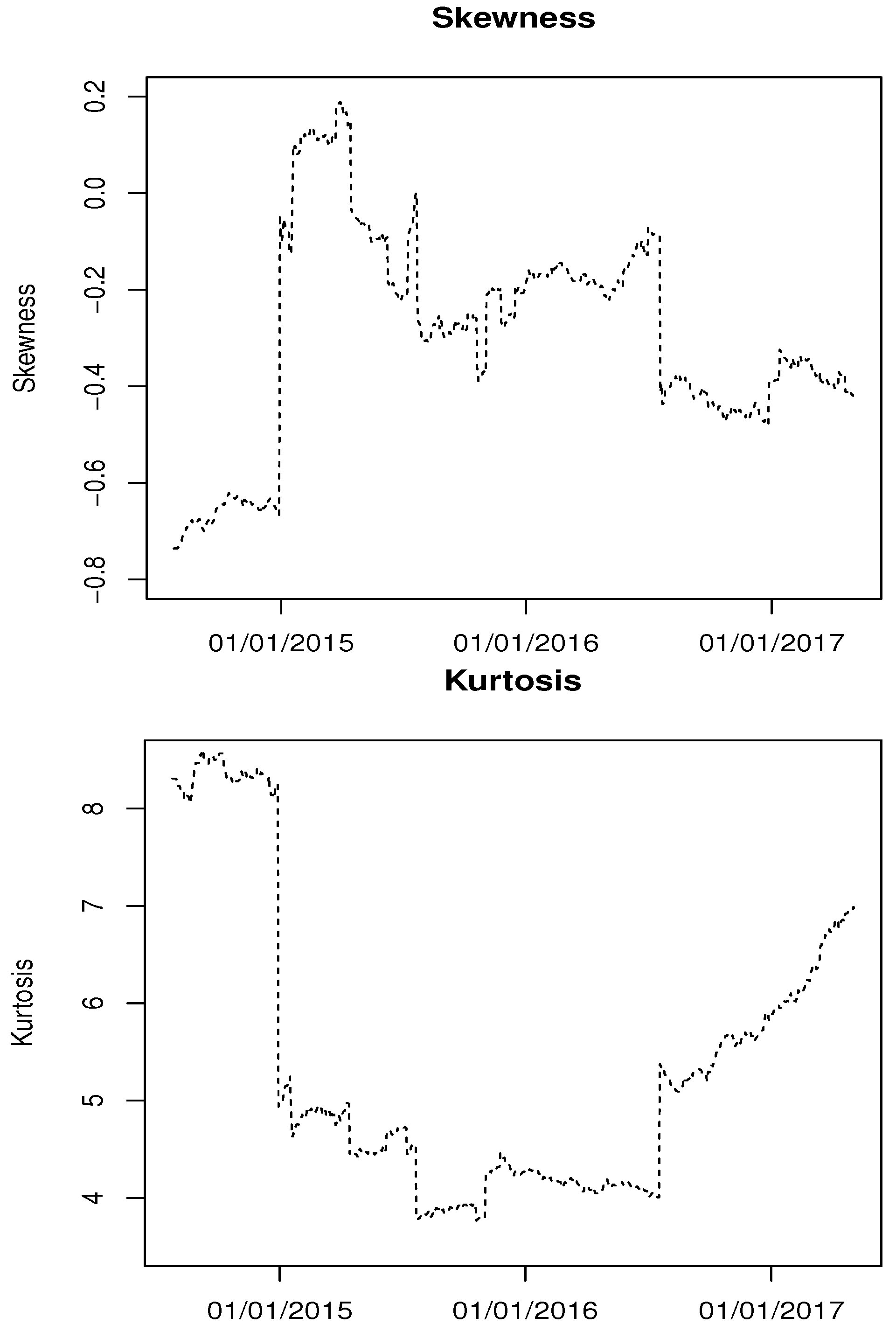

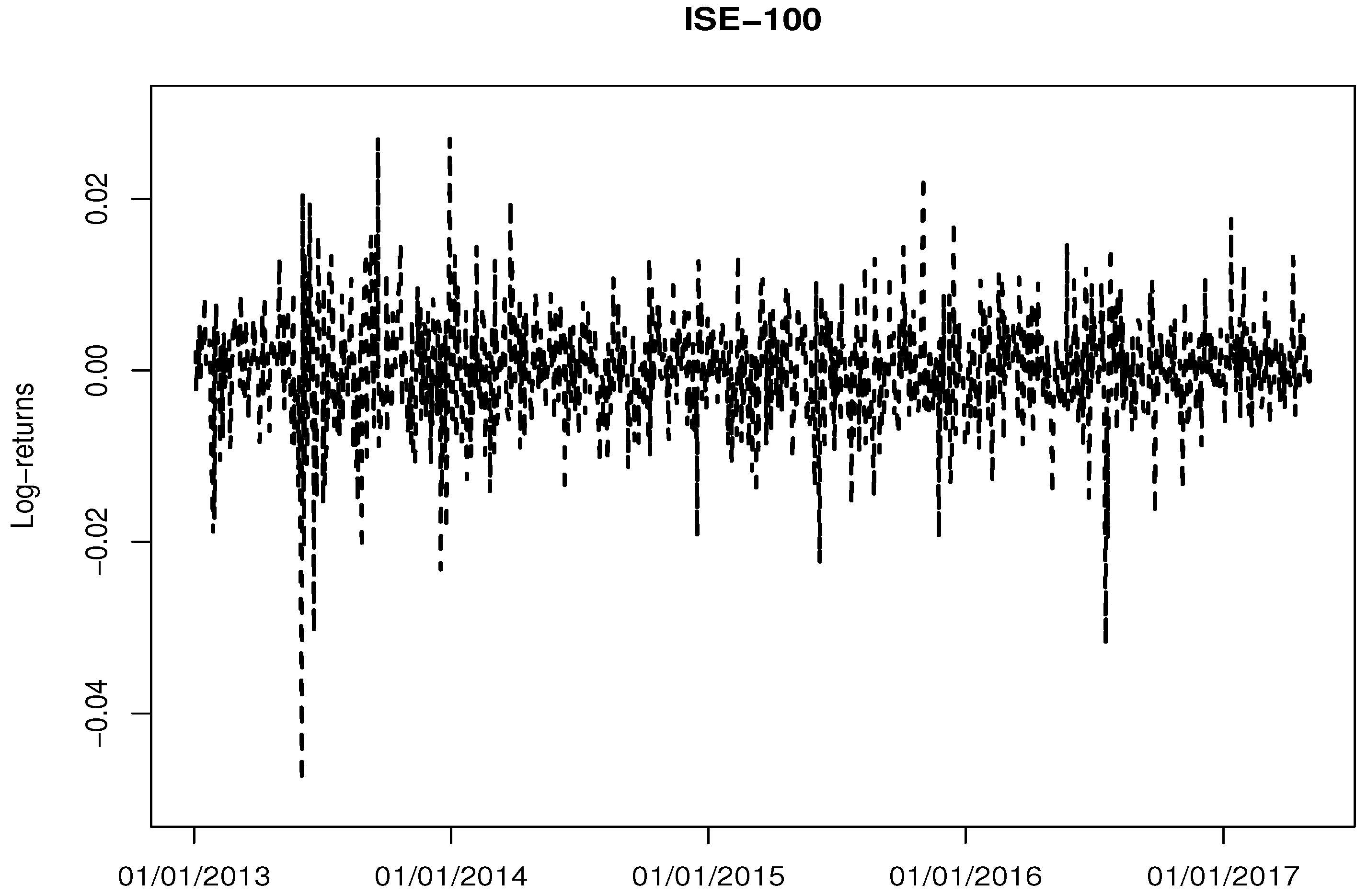

JRFM | Free Full-Text | Does the Assumption on Innovation Process Play an Important Role for Filtered Historical Simulation Model?

![PDF] Filtered Historical Simulation 1 Filtering Historical Simulation . Backtest Analysis | Semantic Scholar PDF] Filtered Historical Simulation 1 Filtering Historical Simulation . Backtest Analysis | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/2b532216befa96f948bafaf0a5b3a9f36d7fc46b/13-Figure3-1.png)

PDF] Filtered Historical Simulation 1 Filtering Historical Simulation . Backtest Analysis | Semantic Scholar

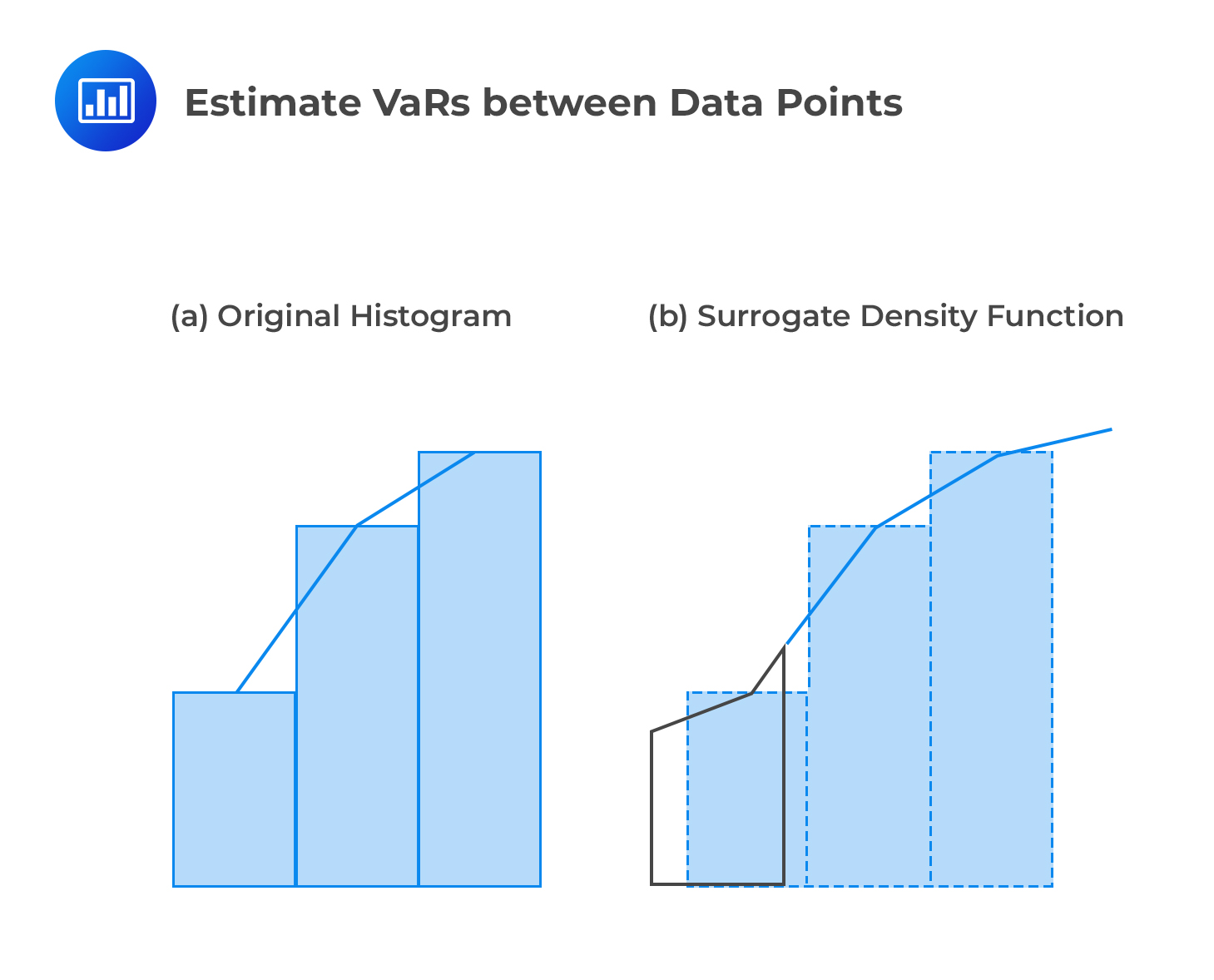

Using Bootstrapping and Filtered Historical Simulation to Evaluate Market Risk - MATLAB & Simulink Example

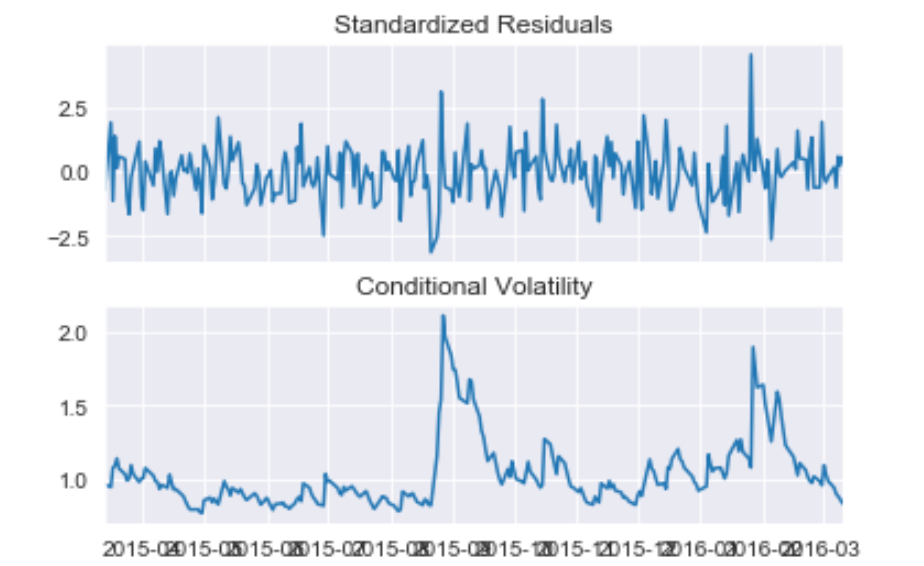

JRFM | Free Full-Text | Does the Assumption on Innovation Process Play an Important Role for Filtered Historical Simulation Model?

![PDF] Filtered Historical Simulation 1 Filtering Historical Simulation . Backtest Analysis | Semantic Scholar PDF] Filtered Historical Simulation 1 Filtering Historical Simulation . Backtest Analysis | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/2b532216befa96f948bafaf0a5b3a9f36d7fc46b/12-Figure2-1.png)

PDF] Filtered Historical Simulation 1 Filtering Historical Simulation . Backtest Analysis | Semantic Scholar